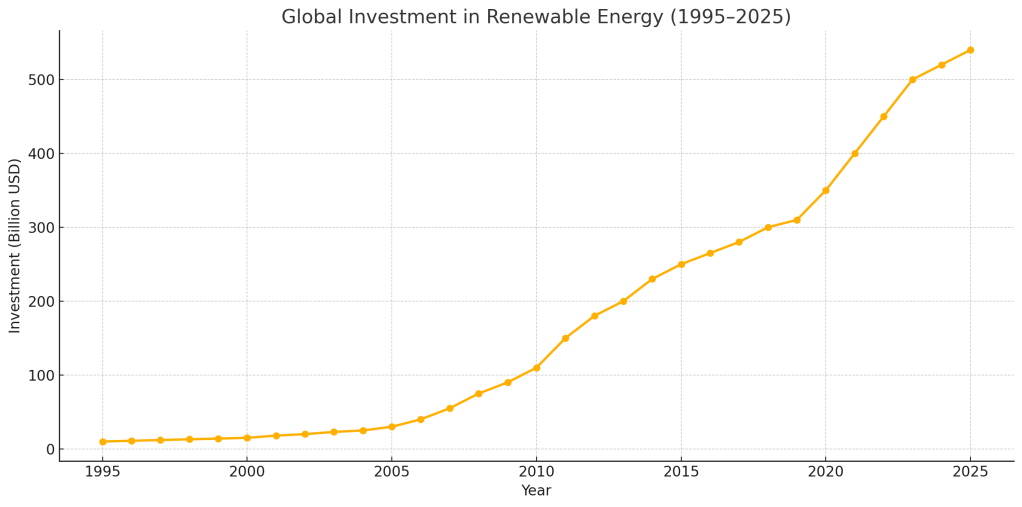

In just three decades, the world has witnessed a radical shift in the way energy is produced and consumed. From a fossil fuel-dominated landscape in the 1990s to a renewable energy revolution by the mid-2020s, global investment in renewables has transformed the future of energy, economics, and environmental policy.

This blog explores the trajectory of global investment in renewable energy from 1995 to 2025, highlighting the catalysts for change, key statistics, and what lies ahead.

🔙 The Early Days: 1995–2005 – Laying the Foundations

Key Highlights:

- Renewables were a niche sector, mainly limited to hydropower and some biomass.

- Global investment in renewables in 1995 was under $20 billion.

- Most projects were government-subsidized pilot programs or small-scale efforts in Europe and North America.

Challenges:

- High production costs of wind and solar.

- Low oil prices made fossil fuels economically attractive.

- Limited public awareness of climate change and sustainability.

Progress:

- The Kyoto Protocol (1997) marked a turning point by recognizing climate change as a global threat and encouraging carbon reduction through cleaner technologies.

- The EU began supporting wind energy in countries like Germany and Denmark.

⚡ Growth and Acceleration: 2005–2015 – Technology Breakthroughs and Policy Support

Key Highlights:

- Investment in renewables soared from $40 billion in 2004 to $285 billion in 2015.

- China emerged as a global leader in renewable investment, surpassing the U.S. and Europe by 2010.

- Solar PV and onshore wind became significantly cheaper due to economies of scale and innovation.

Milestones:

- The Paris Agreement (2015) further strengthened international resolve to invest in clean energy.

- Feed-in tariffs, green bonds, and renewable portfolio standards became common policy tools to attract private sector involvement.

Impact:

- By 2015, renewables accounted for over half of all new power capacity additions globally.

- Job creation in the sector began to surpass that of coal and oil industries in several countries.

🌱 The Sustainability Era: 2016–2025 – Mainstream Adoption and ESG Influence

Key Highlights:

- Cumulative global investment in renewable energy from 2016 to 2025 is estimated at over $3 trillion.

- Solar PV reached grid parity in many countries by 2020, making it cost-competitive without subsidies.

- The growth of Environmental, Social, and Governance (ESG) investing accelerated renewable energy funding from private and institutional investors.

Notable Trends:

- The rise of green hydrogen, battery storage, and offshore wind as next-generation energy solutions.

- Massive investment in electric vehicle (EV) infrastructure, synergizing with renewable energy grids.

- Developing countries, especially in Sub-Saharan Africa and Southeast Asia, began receiving more foreign direct investment for solar and mini-grid projects.

2023–2025 Spotlight:

- Global annual investment in renewables exceeded $500 billion by 2023 (source: BloombergNEF).

- India, Brazil, and Vietnam emerged as key markets, with supportive policies and growing domestic demand.

- Renewable energy now represents over 30% of global electricity generation.

📈 Key Drivers of Investment

- Climate Change Commitments: Government pledges under COP meetings pushed long-term planning and funding.

- Cost Declines: Solar and wind prices fell by over 80% since 2010, making renewables economically viable.

- Technological Innovation: Smart grids, AI in energy forecasting, and better storage made integration easier.

- Public and Private Collaboration: Multilateral banks (like the World Bank and ADB) funded major renewable projects, de-risking investments for private firms.

- Consumer Demand: People began demanding cleaner energy, especially in urban centers and among Gen Z consumers.

🧠 Challenges That Remain

- Intermittency and energy storage limitations.

- Grid infrastructure upgrades needed to handle decentralized renewable sources.

- Policy inconsistency in some nations, with shifts back toward fossil fuels during economic crises.

- Global equity in energy access — many low-income nations still struggle with infrastructure.

🔮 Looking Ahead: Post-2025 Vision

By 2025, renewable energy has crossed the tipping point — not just as a climate solution but as a smart economic strategy. Yet, continued investment and innovation will be essential to:

- Decarbonize industrial processes.

- Electrify transport globally.

- Ensure climate justice and energy access for all.

The journey from 1995 to 2025 proves that bold investment, policy alignment, and technological progress can reshape our energy future. The next challenge is to keep this momentum — and make clean energy the backbone of the 21st-century economy.

🌎 Final Thought

From modest beginnings to a trillion-dollar powerhouse, the story of renewable energy investment is one of human adaptability and planetary urgency. What began as a cautious experiment is now a cornerstone of global development.

The green energy revolution isn’t coming. It’s already here.

You must be logged in to post a comment.